Bitcoin (BTC) may offer investors a rare chance to buy at a support zone with a “100% long hit rate,” new analysis says.

In its latest Update piece on Aug. 29, crypto asset manager Capriole Investments told investors to watch for a BTC price dip to $24,000.

Capriole founder “very confident” in $23,000 BTC price support

Bitcoin continues to track sideways around $26,000, but there is no shortage of market participants predicting further BTC price downside.

$25,000 remains a popular target, but for Capriole, long-term trend lines with an impressive history are of greater interest.

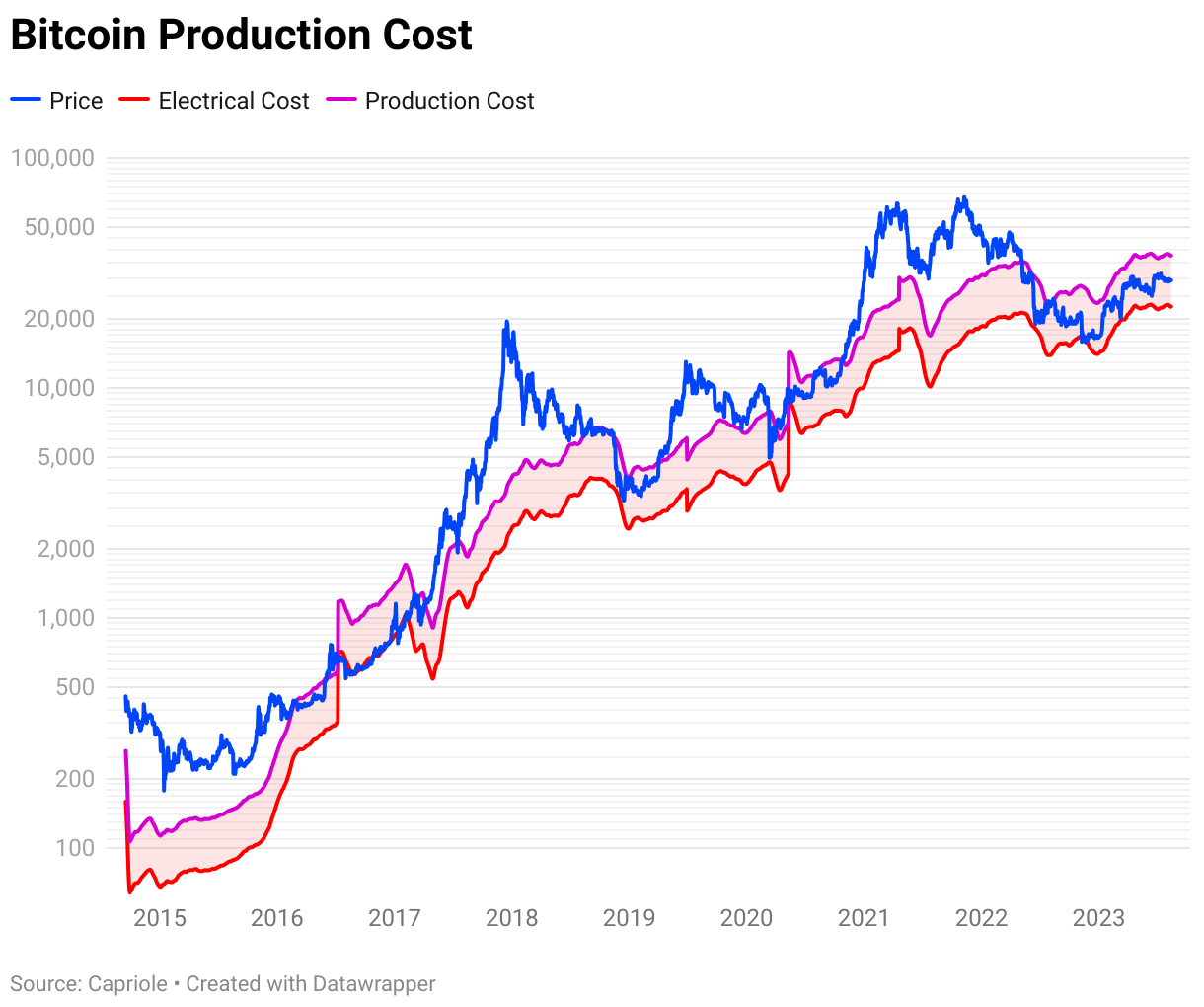

Chief among them are Bitcoin’s weekly support zone at $24,000 and its so-called “Electrical Price” (EP). This refers to the average miner’s electricity bill per BTC worldwide, and currently sits at just over $23,000.

EP has acted as strong support on long timeframes throughout Bitcoin’s history, with the dip to two-year lows in November 2022 being no exception. In late December last year, EP hit lows slightly above $14,000.

Capriole thus describes EP as a “historically hard price floor and level with a 100% long hit rate.”

“Together these price points give very strong confluence from a fundamental and technical perspective to the opportunity that $23-24K presents, should we get there,” it wrote about the technical weekly level and EP, respectively.

In part of a subsequent X post, Capriole additionally described the trend lines as “promising and rare structures” for Bitcoin “worth paying attention to.”

Continuing, Capriole founder Charles Edwards said that $23,000 should act as “rock solid support.”

“I am feeling very confident in $23K being a rock solid support and an incredible long-term opportunity if we get there in the next few weeks,” he told X subscribers on the day.

“Electrical Cost has a 100% hit rate through Bitcoin’s history. It’s my favorite long-term Bitcoin metric.”

Bitcoin miner pain on the horizon?

BTC/USD traded close to $26,000 at the Aug. 29 Wall Street open, per data from Cointelegraph Markets Pro and TradingView.

Analyzing miners’ financial buoyancy, James Straten, research and data analyst at crypto insights firm CryptoSlate, predicted a rerun of BTC price behavior from 2019, as the market laid the foundations of its next bull run.

“Bitcoin miner revenue is currently sitting at $25.5M. Just sitting above the 365SMA of $22.5M,” he noted.

“It looks very reminiscent of the 2019 playbook. Should break below soon.”

Accompanying data from on-chain analytics firm Glassnode showed miners earning less than their yearly average into 2020.

Straten built on findings from Dylan LeClair, senior analyst at digital asset fund UTXO Management, who described the phenomenon as “tradition.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Check other news for today and Please stand by..

*********************************

If one of the paying programs on our Monitor appeals to you, please support EmilyNews by registering for it on our website. Thanks very very much!

EN web Support Chat | Hyips and Crypto questions – HyipChatEN

Telegram Chat for Crypto and Hyip reports: @HyipChatEN

*********************************

Be the first to get most important HYIP news everyday!

Simply Follow EN Facebook, EN Telegram, EN Twitter

or Subscribe to EN Feedburner and submit your email address!

If you like this article and want to support EN – please share it by using at least few of social media buttons below. Thanks and See you tomorrow!