Bitcoin erased gains made a day earlier, rebounding to $104,000, while the market capitalization of all tokens plunged 1.7% to $3.37 trillion.

At last check on Thursday, Bitcoin btc-1.6% Bitcoin traded at around $101,000; the Ethereum

eth-2.68% Ethereum price, meanwhile, dropped by 3.8% in the previous 24 hours to about $3,330.

Crypto crash coincides with stock market dip

Top U.S. indices like the Nasdaq 100, S&P 500, and Dow Jones were down by over 1%, with top blue-chip companies being in the red.

The crash was triggered by a report showing that US companies shed the most job cuts in October in over 20 years. Top companies like Amazon, Target, and UPS have recently announced significant layoffs.

These numbers came a day after another ADP report showed that the economy added 42,000 jobs in October after shedding 32,000 in September. Therefore, traders are assessing the following action by the Federal Reserve, with odds of a cut falling from 95% last week to 65% today.

The stock market is also falling because of the ongoing valuation of most companies and the fear that the AI bubble is about to burst. Some top AI companies, like Palantir and Broadcom, are trading at hefty valuations, with price-to-earnings ratios of 400 and 82, respectively.

It is common for a crypto crash to happen when the stock market is in a steep decline.

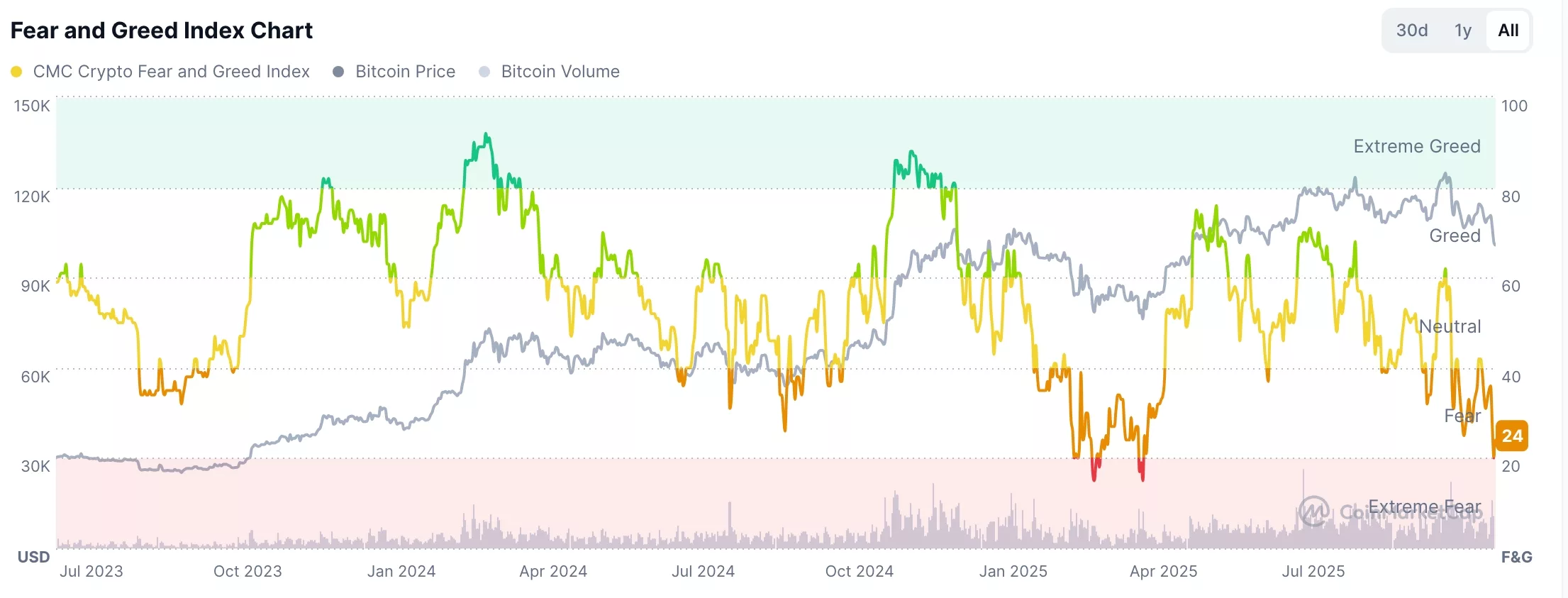

Fear and Greed Index falling

This mini crypto crash is also occurring amid growing investor fear. Data compiled by CMC shows that the Crypto Fear and Greed Index has plunged to the fear zone of 24.

Crypto investors have been timid for about a month, when Bitcoin and most altcoins plunged, leading to a $20 billion wipeout. Over 1.6 million traders were wiped out in a single day. As a result, many have remained on the sidelines, leading to low volume and futures interest.

Data compiled by CoinGlass shows that the 24-hour open interest plunged by 3.45% to $140 billion. This is a significant decline from last month’s high of over $300 billion.

The ongoing crypto crash confirms the view that Wednesday’s market rally was part of a dead-cat bounce —a temporary rebound during a downturn.

What’s next for Bitcoin price as Bitcoin ETFs remain under pressure?

Bitcoin’s recent bounce off the $99,000 support level has done little to ease bearish sentiment in the market. Earlier in the cycle, a strong break above this zone in May sent BTC into a rally and ultimately a string of new all-time highs.

That momentum saw price discovery push BTC as high as $126,200. After 135 days, BTC has now returned to a familiar support but the reaction is much more muted, with confidence failing to recover alongside the latest bounce.

Attention now shifts to the $106,000 zone, which has turned from support to resistance. The present environment of caution and weak demand could see this barrier hold, forcing BTC back below $100,000 if buyers fail to step in.

Current price action suggests that large investors are not interested in decisive moves right now. As a result, BTC may remain stuck in a range between $99,000 and $106,000 until a clear trigger emerges to break the deadlock.

*********************************

Be the first to get most important HYIP news everyday!

Simply Follow EN Facebook, EN Telegram, EN Twitter

or Subscribe to EN Feedburner and submit your email address!

If you like this article and want to support EN – please share it by using at least few of social media buttons below. Thanks and See you tomorrow!