President Donald Trump announced the end of the Biden administration’s “war on bitcoin and crypto” during a speech this week at Miami’s FII Priority Summit, vowing to solidify the U.S. as the world’s undisputed leader in digital currency innovation.

‘America Will Be the Crypto Capital,’ Trump Says at Summit

Trump declared an end to what he termed the Biden administration’s “war on bitcoin and crypto” during a keynote address at Saudi-backed Miami’s FII Priority Summit this week, positioning his administration as a catalyst for U.S. dominance in digital currencies. The 47th president highlighted his commitment to making America the “crypto capital” of the world, citing bitcoin’s recent all-time highs as evidence of market confidence in his economic agenda.

Speaking to global business leaders and foreign dignitaries, Trump linked economic growth to broader revitalization. “Since the [November] election, America’s economic engines have come roaring back to life in just a very short period of time,” he said, highlighting a nearly 10% surge in the Nasdaq and bitcoin’s “multiple all-time record highs.” He praised Miami as the “center of the action” for crypto innovation and hinted at deregulatory measures to attract blockchain investments.

Trump also spotlighted his newly established Department of Government Efficiency (DOGE), a cost-cutting initiative spearheaded by Elon Musk. The department aims to eliminate “wasteful spending,” with Trump proposing to redirect 20% of savings to taxpayers and debt reduction. “We’re saving billions every single day,” Trump claimed, crediting Musk’s “high IQ” and tech expertise for ensuring transparency. While short on specifics, Trump tied DOGE’s mission to fostering a pro-business climate for crypto expansion.

The president sharply criticized Biden-era policies, blaming “crushing regulations” and “rampant inflation” for stifling innovation. He contrasted this with his administration’s hiring freezes and foreign aid pauses, framing them as foundational to a “Golden Age of American prosperity.” Trump also lambasted international aid programs, citing examples as misplaced priorities now being redirected toward domestic initiatives.

Trump’s pro-crypto rhetoric drew applause from attendees, including Saudi officials and tech executives. He closed by reiterating his pledge to keep the U.S. at the “forefront of everything,” and “one of them is crypto.”

🚨JUST IN: President Trump (@POTUS) says he ended Biden’s war against crypto. He also said his administration is “committed to making America the crypto capital.” pic.twitter.com/R9J73m6zCi

— Bitcoin.com News (@BTCTN) February 20, 2025

In the past 24 hours, Bitcoin [BTC] experienced notable volatility. Short-Term Holders (STHs) realized substantial losses, likely driven by panic-selling following the Bybit hack news.

Also, over the past 16 hours, BTC’s 4-hour chart on Binance showed significant bearish indicators.

The Exponential Moving Average (EMA) cross displayed a bearish crossover, with the 9-period EMA dropping below the 26-period EMA around hour 14, signaling short-term downward momentum.

This aligned with BTC’s price decline to $96,259.9, marking a -0.12% drop from the previous period.

Source: CoinGlass

The Relative Strength Index (RSI) stood at 46.05, reflecting a neutral but slightly bearish outlook.

This RSI level suggested that BTC remained in a consolidation phase, with no clear overbought or oversold conditions. If it rebounds above 50, bullish sentiment might return, supporting price recovery.

Also, the Cumulative Volume Delta (CVD) showed a net volume delta of -94.67K, reflecting strong selling pressure in the last 8 hours.

These signals collectively pointed to capitulation, where STHs offloaded BTC, potentially forming a short-term local bottom as selling pressure diminished.

Panic selling peaks: What is the turning point?

The Short-Term Holder Profit & Loss (P&L) to Exchanges Sum chart for the last 24 hours also highlighted significant losses among STHs.

The dominance of red bars, peaking at -43.9K BTC, indicated heavy panic-selling around $90K to $95K following the Bybit hack news.

Source: CryptoQuant

The STH profit line remained minimal, reinforcing the idea that few short-term traders saw gains. Similar trends occurred in early 2022, where high realized losses preceded short-term price recoveries.

This data suggested a potential local bottom, as distressed selling often exhausts downward momentum, creating a possible buying window for traders.

BTC’s liquidity shift

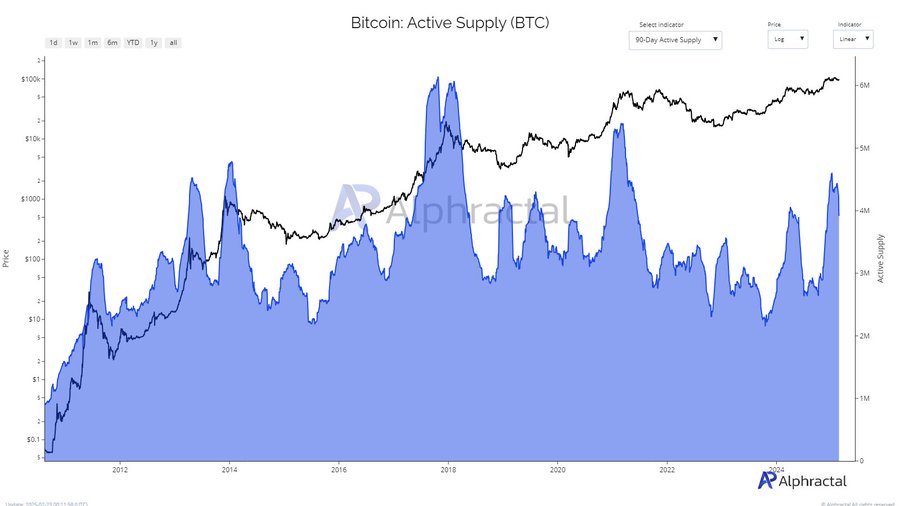

Analysis of the 90-Day Active Supply chart for BTC, covering 2012 to 2025, reflected a notable decline in recent months. As of early 2025, active supply hovered around 4M BTC, down from 6M BTC in late 2024.

Source: Alphractal

This metric, indicated a decline in trading activity. Normally, rising active supply suggests higher demand and bullish sentiment, while declines signal distribution and reduced interest.

The current trend implied STHs had largely exited, potentially reducing selling pressure.

This pattern mirrored 2018, when declining active supply preceded price stabilization, supporting the capitulation hypothesis and reinforcing short-term bottom formation.

A sign of strength or further decline?

Deep analysis showed that BTC netflow chart for aggregated exchanges over the last three months revealed a sharp net outflow of -546.11 BTC in the past 24 hours.

This was a significant reversal from the previous week’s +226.57 BTC average inflows, and the 30-day average of +1.29K BTC inflows.

Source: IntoTheBlock

A sudden negative netflow typically indicates that holders are withdrawing BTC to off-exchange wallets, suggesting reduced selling pressure.

This pattern resembled mid-2021, when large BTC outflows preceded price rebounds. Additionally, the 24-hour netflow change of +269.71 BTC suggested renewed buying interest.

In conclusion, Capitulation events, such as heavy short-term holder losses and declining exchange netflows, historically precede short-term recoveries.

While short-term volatility remains, long-term indicators suggest a potential shift toward recovery as selling pressure subsides.

*********************************

If one of the paying programs on our Monitor appeals to you, please support EmilyNews by registering for it on our website. Thanks very very much!

EN web Support Chat | Hyips and Crypto questions – HyipChatEN

Telegram Chat for Crypto and Hyip reports: @HyipChatEN

*********************************

Be the first to get most important HYIP news everyday!

Simply Follow EN Facebook, EN Telegram, EN Twitter

or Subscribe to EN Feedburner and submit your email address!

If you like this article and want to support EN – please share it by using at least few of social media buttons below. Thanks and See you tomorrow!