GameStop is considering investing in Bitcoin, and the news already started impacting its stock price. CEO Ryan Cohen recently posted a photo with MicroStrategy’s Michael Saylor, and his firm may serve as a blueprint.

GameStop previously tried to enter the Web3 market with its NFT marketplace, but this proved unsuccessful. Bitcoin is completely unrelated to its core business model and may dramatically change the company, but its revenues would keep it afloat.

Will GameStop Follow MicroStrategy’s Footsteps?

GameStop, ostensibly a gaming and electronics retailer, has changed a lot in the last few years. After steadily declining revenues, a Reddit-driven stock squeeze in 2021 brought about a legendary stock pump. This event rejuvenated company leadership, prompting new Web3-oriented business solutions like an NFT marketplace.

However, GameStop’s momentum couldn’t last forever; the firm fired CEO Matthew Furlong in 2023 and shuttered its NFT marketplace the following January.

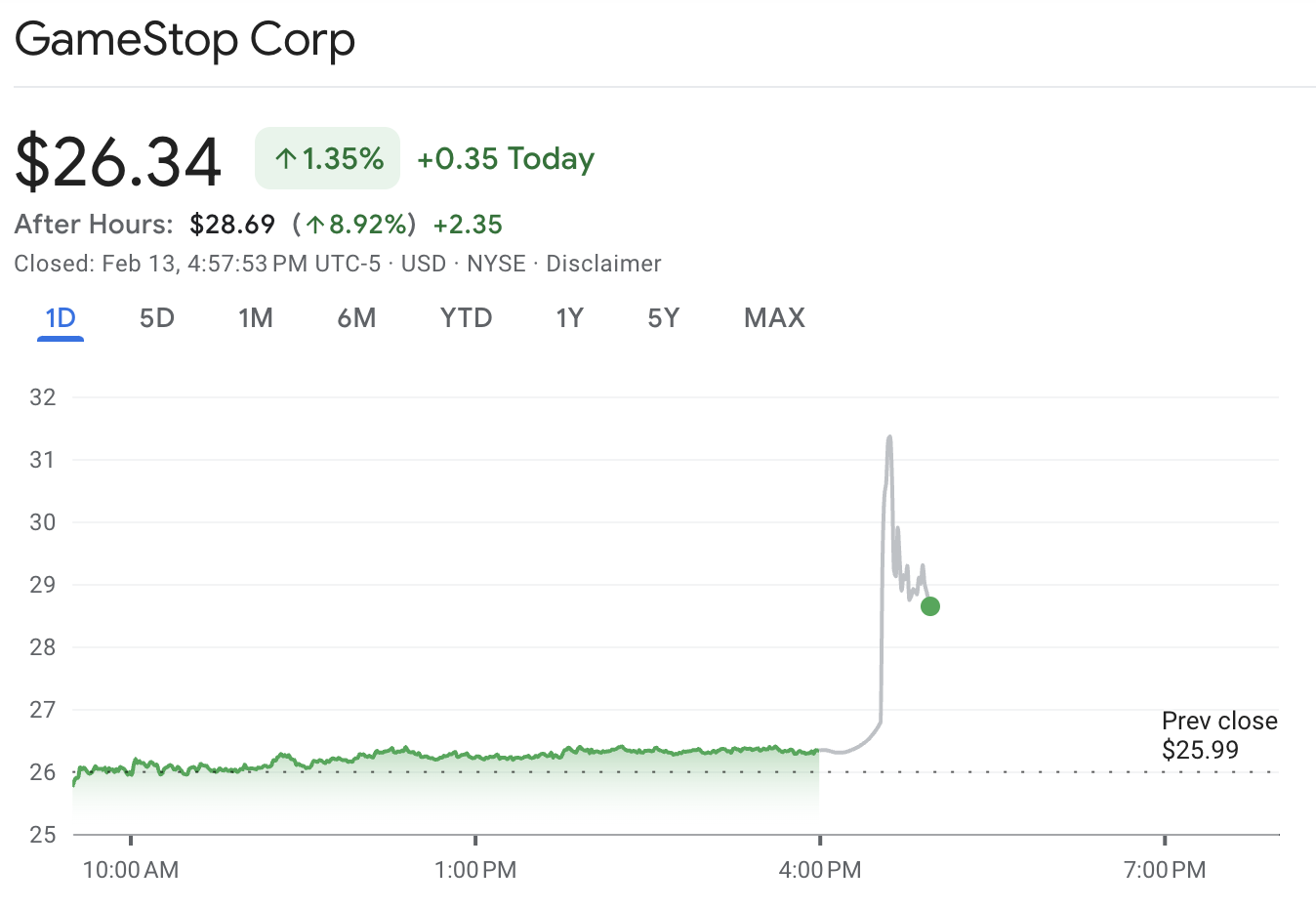

Today, however, GameStop is preparing to take a truly radical step: investing in Bitcoin. According to published rumors, the firm may invest in it and other cryptoassets soon. The news quickly had a notable impact on its stock price.

The price of Bitcoin has been extremely bullish in recent months, but that doesn’t fully explain GameStop’s decision. Despite the recent liquidations triggered by Trump’s geopolitical decisions, Bitcoin is starting to stabilize.

Given BTC is still below $100,000 and analysts predict much higher prices by the end of the year, it would be an optimal time for GameStop to add Bitcoin to its portfolio. The decision seems to be somewhat inspired by MicroStrategy’s Michael Saylor.

Before buying Bitcoin, MicroStrategy was in a very similar position to GameStop. Saylor saw revenues from its traditional business model drying up and made a dramatic gamble on BTC.

This bet has paid off extraordinarily well, and Saylor recently rebranded the company to prominently feature the Bitcoin logo.

“GameStop, a company with no viable business plan, has thrown another Hail Mary by announcing that it might use its cash to buy Bitcoin. The irony is that Bitcoin is even more overpriced than GME. No matter; speculators are buying the stock anyway, hoping it becomes another MSTR,” wrote anti-crypto advocate Peter Schiff.

In other words, Saylor’s Bitcoin rebrand could serve as a blueprint for GameStop. The company tried to adapt to meet Web3 market opportunities when it entered the NFT market, but this wasn’t enough. Many of its NFTs were gaming-themed, and this proved a niche market. Bitcoin, however, has nothing to do with its old business model.

Committing to a Bitcoin-first strategy could completely change GameStop’s revenue model. MicroStrategy was totally transformed by its pivot to BTC. Even Tesla, one of the world’s largest tech firms, has noticeably changed due to its crypto purchases.

However, no further updates regarding any accumulation plans have been revealed yet.

Bearish pressures: ETF outflows and retail capitulation

While historical price patterns indicate a bullish setup, ETF outflows and declining retail participation remain key bearish factors.

On February 12, Bitcoin ETFs saw over $251 million in net outflows, marking the third consecutive day of negative flows and bringing the total to $494 million, according to Farside Investors data.

Meanwhile, on-chain metrics suggest growing retail capitulation. Data from Santiment reveals that the total number of non-empty Bitcoin wallets has dropped to 54.44 million, its lowest level since December 10.

This marks a loss of 277,240 wallets in just three weeks, a sign that small traders are exiting the market out of fear of further downside.

Macroeconomic pressures could delay a breakout

Beyond technical indicators, macroeconomic concerns continue to cast a shadow over Bitcoin’s short-term price action.

The latest Producer Price Index (PPI) figures, released on February 13, came in higher than expected at 0.4% month-on-month and 3.5% year-on-year, respectively.

The data further dims hopes for near-term Federal Reserve rate cuts, keeping pressure on risk assets, including Bitcoin, though BTC saw a brief uptick following the release.

According to the CME Group’s FedWatch Tool, traders now see just a 2.5% chance of a 0.25% rate cut at the Fed’s March meeting. The hawkish stance has fueled investor caution, adding uncertainty to Bitcoin’s near-term trajectory.

Bitcoin key levels to watch

As Bitcoin hovers near crucial price levels, market watchers are eyeing key resistance and support zones.

According to crypto analyst Ali Martinez, Bitcoin’s most important resistance level currently stands at $97,530. A decisive break above this level could signal renewed bullish momentum, supporting Bitcoin’s attempt to reclaim higher highs.

However, on the downside, support below $92,110 appears weak, with a notable gap between $90,000 and $70,000. This suggests that if BTC loses the $92,110 level, it could experience heightened volatility, potentially leading to a sharper correction.

As Bitcoin hovers around key technical zones, traders remain cautious, balancing bullish cycle expectations with macroeconomic uncertainties that could prolong the consolidation phase.

*********************************

If one of the paying programs on our Monitor appeals to you, please support EmilyNews by registering for it on our website. Thanks very very much!

EN web Support Chat | Hyips and Crypto questions – HyipChatEN

Telegram Chat for Crypto and Hyip reports: @HyipChatEN

*********************************

Be the first to get most important HYIP news everyday!

Simply Follow EN Facebook, EN Telegram, EN Twitter

or Subscribe to EN Feedburner and submit your email address!

If you like this article and want to support EN – please share it by using at least few of social media buttons below. Thanks and See you tomorrow!