Bitcoin price rebounds 6% to Retake $100K

Amid escalating trade war tensions, Bitcoin faced intense selling pressure over the weekend, as U.S. traders moved funds away from risk assets in response to inflation concerns. The uncertainty triggered a wave of sell orders queued up ahead of Monday’s market open, pushing BTC into a sharp decline.

However, as the day progressed, institutional investors capitalized on the dip, swiftly acquiring BTC at lower price levels, sparking a rapid market recovery. TradingView data shows Bitcoin rebounded by 6% to reclaim the $101,000 mark at press time.

Market watchers suggest that the recent trade conflict could ultimately prove bullish for BTC. Protectionist policies often lead to heightened global economic uncertainty, prompting investors to seek alternative assets. The confluence of these factors is fueling speculation that BTC could soon challenge all-time highs.

“It’s remarkable the difference a day can make in the crypto world. What we have seen over the weekend is how, with one hand, Trump can make crypto leap to new highs, and with the other, he can wave his magic tariff wand and wipe out all the gains in both the crypto and equity markets.”

“Although the Trump factor is certainly at play, the recent downturn in Bitcoin’s value and the broader decline across global equity markets can also be attributed to technological disruptions, particularly as the AI arms race becomes red-hot following the introduction of DeepSeek.”

– James Toledano, COO at Unity Wallet.

Bulls Mount $1.8B Support Around $90K as BTC Fights Back

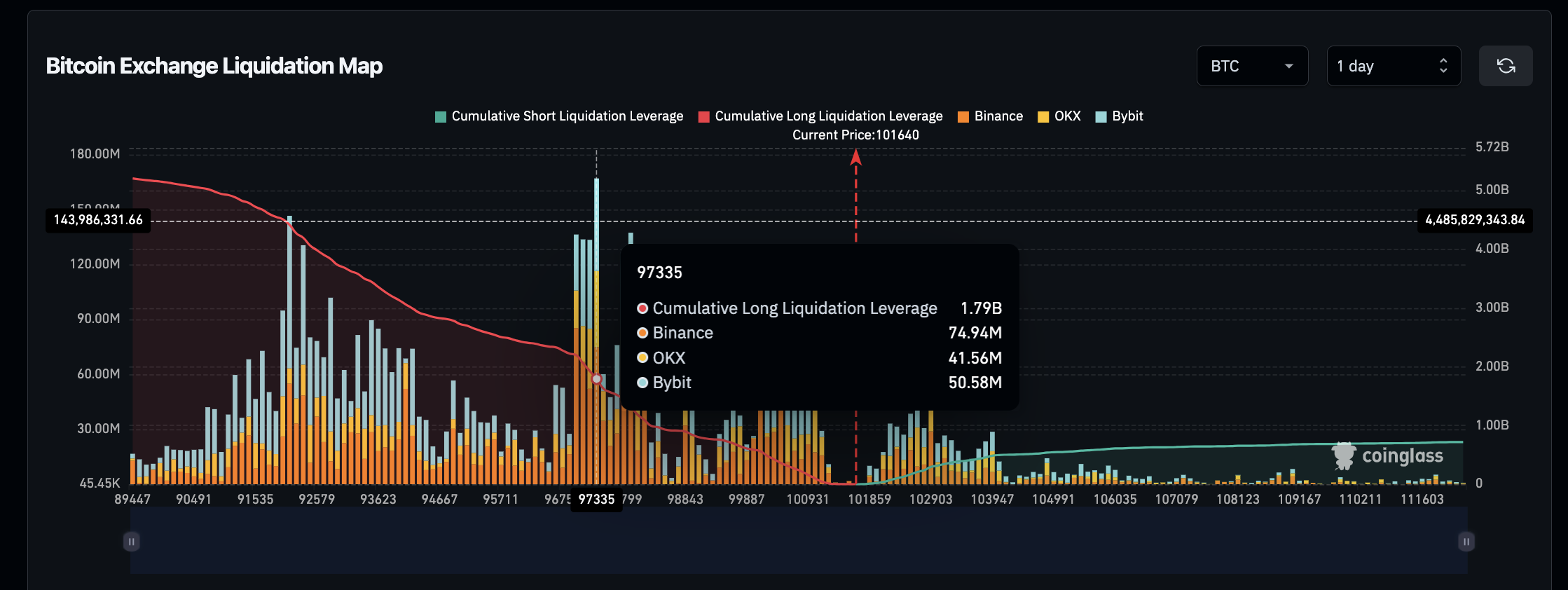

Bitcoin’s recent volatility has been closely monitored through Coinglass Liquidation Map charts, which provide a snapshot of key price levels where traders have positioned leverage. Clusters of high-leverage positions indicate areas of significant speculative trading interest, with traders likely to defend these levels aggressively.

Bitcoin (BTC) Liquidation Map | Source: Coinglass

The latest data highlights a key support level at $90,000, where bulls have concentrated $1.8 billion in leverage—representing nearly 40% of the total $5.2 billion in long positions currently open. This surge in bullish leverage has now restored dominance to long traders, whose $5.2 billion in positions far exceeds the active short leverage of $700 million.

With bulls now back in control, Bitcoin’s price action may be setting up for a classic bear trap, where market makers strategically liquidate short positions before reversing the market to the upside. Should this scenario play out, BTC could be poised for a sustained bullish breakout, potentially testing new all-time highs in the coming weeks.

Check other news for today and Please stand by..

*********************************

If one of the paying programs on our Monitor appeals to you, please support EmilyNews by registering for it on our website. Thanks very very much!

EN web Support Chat | Hyips and Crypto questions – HyipChatEN

Telegram Chat for Crypto and Hyip reports: @HyipChatEN

*********************************

Be the first to get most important HYIP news everyday!

Simply Follow EN Facebook, EN Telegram, EN Twitter

or Subscribe to EN Feedburner and submit your email address!

If you like this article and want to support EN – please share it by using at least few of social media buttons below. Thanks and See you tomorrow!