As we can see, the recent notes were correct .. The problems of regulating cryptocurrencies and bitcoin, in particular, force investors / holders to stay on the sidelines at the moment, so the fewer buyers and more sellers we see , the deeper the price correction is possible.

I firmly believe that all these are temporary things that can be removed from the general narrative in a second, and the price can launch a second wave UP, but when and how (with or without even deeper correction down) is the main question…

Bitcoin is declining as regulatory concerns rise.

Bitcoin extended its pullback on Tuesday as buyers continue to take profits from the $40,000 resistance level. The cryptocurrency was trading around $38,000 at press time and is down about 4% over the past week. Ongoing regulatory concerns in the U.S. and China have kept some bitcoin buyers on the sidelines, with lower support seen around $34,000 to $36,000.

“We expect the pullback to mature in one to two weeks near the 50-day moving average around $34K, after which bitcoin is likely to clear $42.6K for a revised upside target near $51K,” wrote Katie Stockton, managing director of Fairlead Strategies, in a Monday newsletter.

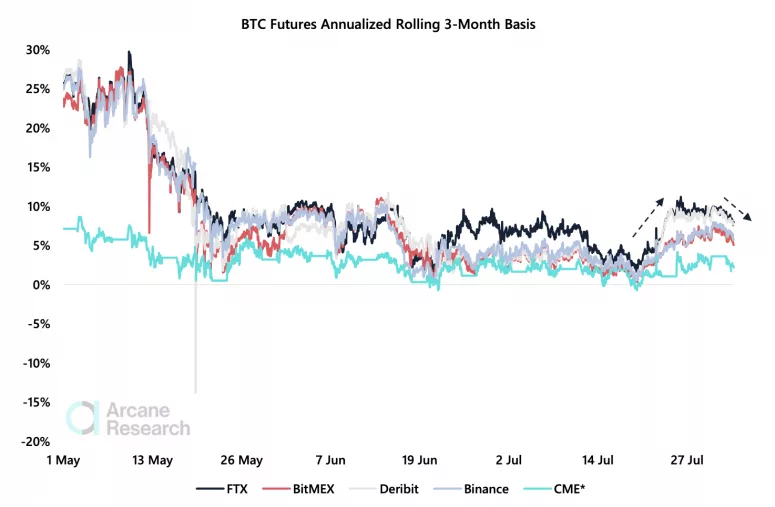

Bitcoin futures contango

“Last week’s short squeeze led a large contango to open in the futures market, but as bitcoin failed to break out from its range the contango has declined in recent days,” wrote Arcane Research in a Tuesday newsletter.

Contango is a term used to describe bullish arbitrage, which occurs when the bitcoin futures price is higher than the spot price. Since April, bitcoin’s contango has narrowed as bullish sentiment waned.

“The CME contango remains substantially below the unregulated exchanges, suggesting that the institutional investors remain more cautious than the crypto native traders,” Arcane wrote.

The growing contango could also suggest an accumulation of leveraged long positions, albeit slightly lower over the past week. “Be wary of potential long squeezes if bitcoin fails to find support above $37,000,” Arcane wrote.

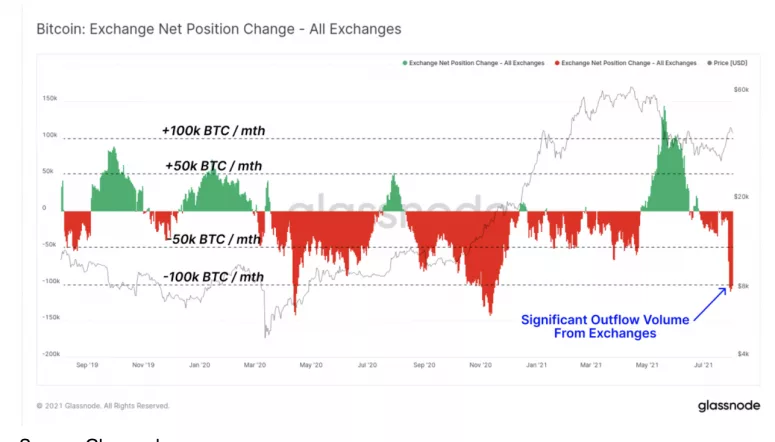

Exchange outflows

A significant amount of bitcoin has flowed out of exchanges over the past week, which could indicate investors’ preference to hold rather than sell positions.

“The exchange net position change metric maps out the monthly rate of coins flowing in (green) or out (red) of all exchanges,” wrote Glassnode in a Monday newsletter. “This week we have seen an extremely large volume of coins flow out of exchanges, comparable to the peak outflows seen in November 2020.”

Chart shows bitcoin net position change across exchanges.

Source: GlassnodeStablecoins in the spotlight

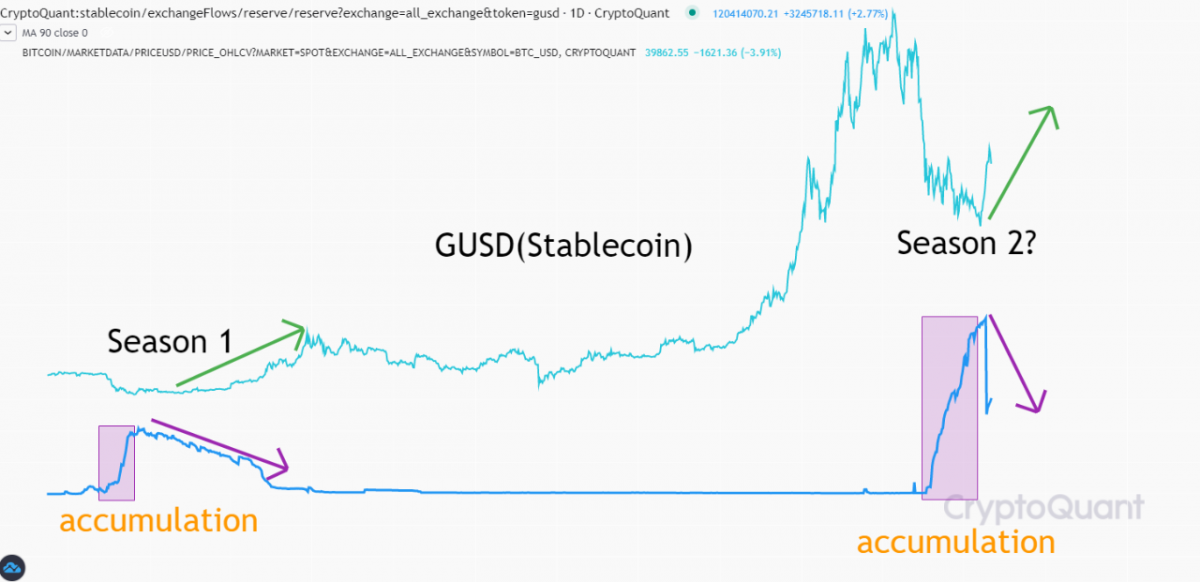

The amount of the stablecoin gemini dollar (GUSD) on exchanges has seen a sharp decline recently, which may imply an ongoing rise in bitcoin’s price, according to a chart by Mignolet on CryptoQuant. In 2018, when the downward trend of bitcoin price was reversed, GUSD saw a drop in its amount.

GUSD amount on exchanges vs. bitcoin price

Source: CryptoQuant

*********************************

If one of the paying programs on our Monitor appeals to you, please support EmilyNews by registering for it on our website. Thanks very very much!

EN web Support Chat | Hyips and Crypto questions – HyipChatEN

Telegram Chat for Crypto and Hyip reports: @HyipChatEN

*********************************

Be the first to get most important HYIP news everyday!

Simply Follow EN Facebook, EN Telegram, EN Twitter

or Subscribe to EN Feedburner and submit your email address!

If you like this article and want to support EN – please share it by using at least few of social media buttons below. Thanks and See you tomorrow!